Introduction: Why the “Rainy Day” is Now a “Flash Flood” in 2026

In the volatile economic landscape of 2026, the traditional advice to “save for a rainy day” has undergone a radical transformation. We no longer live in an era of 30-year career stability or predictable inflation. With the rise of the high-speed gig economy, AI-driven job displacement in white-collar sectors, and the staggering cost of living in Tier-1 countries, an emergency fund is no longer a “nice-to-have” financial cushion — it is a financial survival tool.

In early 2026, the labor market has shifted into what economists call the “Efficiency Era.” Major corporations are no longer just trimming fat; they are re-architecting entire workforces around automation. In January 2026 alone, nearly 600,000 jobs were lost across tech, logistics, and finance as firms like Amazon and UPS integrated AI infrastructure to replace middle-management and administrative roles.

This guide is a deep-dive into emergency savings, liquidity management, financial psychology, income replacement planning, and wealth protection strategies — giving you the precise math required to protect your peace of mind in 2026. According to the U.S. Federal Reserve, nearly 40% of adults struggle to cover a $400 emergency expense without borrowing.

1. What Is an Emergency Fund? (Definition, Purpose, and Meaning)

To build an effective emergency fund, we must first define what it is — and just as importantly, what it is not.

The Core Definition of an Emergency Fund

An emergency fund is a dedicated pool of highly liquid cash set aside specifically to cover unexpected, non-discretionary expenses or to replace lost income during financial emergencies such as job loss, medical emergencies, or urgent repairs.

The “Liquidity” Requirement Explained

In finance, liquidity refers to how quickly an asset can be converted into cash without losing value.

- Highly Liquid Assets: Cash stored in a High-Yield Savings Account (HYSA). You can transfer funds to your checking account within seconds or minutes.

- Low Liquidity Assets: Real estate, retirement accounts (401(k), RRSP), or long-term investments. If you need $5,000 for emergency surgery tomorrow, you cannot sell part of your home or withdraw retirement funds without penalties or delays.

In 2026, many investors fall into the “Liquidity Trap.” They assume that having $50,000 in stocks equals financial safety. However, stock markets and labor markets are often correlated. If a market crash triggers mass layoffs, you may be forced to sell assets at a loss — destroying years of compounding growth just to pay your rent.

True Emergencies vs. Lifestyle “Oopsies”

Understanding Non-Discretionary Spending is critical. These are expenses you must pay to survive.

- True Emergency: Your HVAC system fails during a record-breaking London heatwave. Repair cost: £5,000. This is a health and safety necessity.

- Lifestyle “Oopsie”: Your favorite artist announces a surprise 2026 world tour. While the FOMO (Fear of Missing Out) feels urgent, this is Discretionary Spending. Using your emergency fund for this is a budget failure, not a financial emergency.

2. Why Tier-1 Residents Face Unique Financial Risks in 2026

Living in a developed, Tier-1 country (USA, UK, Canada, Australia, Western Europe) offers high earning potential but also introduces specific financial vulnerabilities.

The OECD highlights how job market volatility has increased due to automation and AI displacement, increasing the need for stronger financial safety nets.

The Debt Dependency Trap

The modern Tier-1 lifestyle in 2026 is fueled by credit-based living — mortgages, auto loans, student debt, credit cards, and Buy Now, Pay Later (BNPL) financing.

The Math of Risk: If your monthly fixed obligations equal $4,000 and your income stops, you are not financially “neutral.” You are actively losing $4,000 every 30 days. Without emergency savings, you will likely rely on high-interest credit cards (often exceeding 24% APR in 2026), triggering a debt spiral that is extremely difficult to escape.

The “Safety Net” Lag

Many Tier-1 residents rely on government assistance systems. However, in 2026, these systems are under extreme strain.

- Example: In the UK, redundancy claims often take 5 to 8 weeks to process. If your mortgage is due in 15 days, the system hasn’t failed — it’s just delayed. Your emergency fund becomes the financial bridge that keeps you housed and fed until support arrives.

3. How Much Emergency Fund Do You REALLY Need? (2026 Personalized Formula)

The traditional “3 to 6 months of expenses” rule is a decent starting point — but in today’s specialized job market, one size fits none.

Factor 1: Job Stability & Income Replacement Speed

Ask yourself: How long would it realistically take me to find equivalent employment if I lost my job today?

- Highly Specialized Professionals (9–12 Months): AI ethics consultants, fintech lawyers, biotech researchers — limited roles at high pay levels.

- High-Demand Skilled Workers (3–4 Months): Nurses, electricians, cybersecurity analysts — faster job replacement due to labor shortages.

Factor 2: The Dependent Multiplier

In 2026, dependents include more than children — they include elderly parents, disabled family members, or pets with chronic medical needs.

- Single / No Dependents: High flexibility — you can relocate, reduce expenses, and adapt quickly.

- Parents / Caregivers: Expenses are fixed — you cannot cancel school fees, medications, or care services.

2026 Rule of Thumb: Add 1 additional month of expenses to your emergency fund target for each dependent in your household.

Factor 3: Geographic Cost of Living (COL) in 2026

Your Survival Number — the minimum monthly cost to survive — varies drastically by city:

| City | Estimated Monthly Survival Cost (2026) | 6-Month Emergency Fund Goal |

|---|---|---|

| New York City, USA | $3,800 | $22,800 |

| Sydney, Australia | AU$4,100 | AU$24,600 |

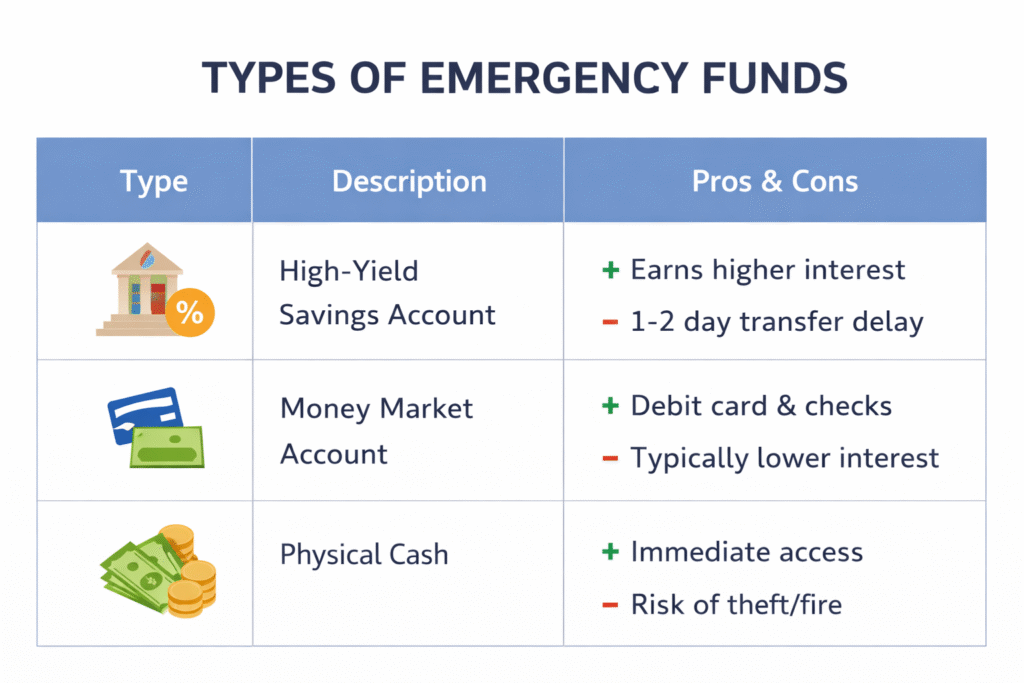

4. Where to Store Your Emergency Fund in 2026 (Best Accounts Ranked)

Inflation in 2026 remains a silent wealth eroder. Keeping $20,000 in a checking account earning 0.01% is a financial mistake. Financial experts at Investopedia recommend keeping emergency savings in high-yield savings accounts for better liquidity and interest growth.

High-Yield Savings Account (HYSA) — Best Option

The gold standard for emergency funds. In early 2026, top digital banks like Varo, Marcus, and Ally offer 4.2% to 5.0% APY.

- Advantage: Your money earns interest and partially offsets inflation.

- Bonus Benefit: A 1–2 business day transfer delay discourages impulsive withdrawals — a psychological safeguard.

Money Market Accounts (MMA)

A hybrid between checking and savings.

- Best For: Immediate access. Many MMAs include debit cards and check-writing features — ideal for emergency repairs at odd hours.

What to Avoid Storing Emergency Funds In

- Cryptocurrency: Even in 2026, crypto remains too volatile for emergency savings.

- Physical Cash: Holding more than $1,000 at home increases theft, fire, and loss risk.

5. How to Build an Emergency Fund from Zero (Step-by-Step 2026 Plan)

Do not let a $30,000 target overwhelm you. Use the Milestone Method.

Phase 1: Starter Emergency Fund ($2,500)

This fund covers minor but urgent expenses — flat tires, appliance failures, emergency vet visits — and allows you to stop relying on credit cards for every inconvenience.

Phase 2: Calculate Your Survival Number

List bare-minimum expenses only:

- Housing: Rent/mortgage, property taxes, utilities.

- Healthcare: Insurance premiums, essential prescriptions.

- Food: Basic groceries only.

- Debt Obligations: Minimum payments on all debts to protect your credit.

Phase 3: Automation & Behavioral Finance

Humans are present-biased — if we see money, we spend it.

- Strategy: Use split direct deposit. Example: If your paycheck is $5,000, send $500 directly to your HYSA. Money you never see becomes money you never spend.

6. Real-World Case Study: The 2026 Tech Correction

Profile: David, Software Engineer in San Francisco earning $180,000.

Event: His employer automates 30% of coding roles using Agentic AI in March 2026. David is laid off.

Scenario A: No Emergency Fund

David had $0 in cash but $100,000 invested in stocks. The market dipped simultaneously, reducing his portfolio to $80,000. He sold $30,000 to survive 5 months — permanently locking in a $7,500 loss and missing the recovery.

Scenario B: Fully Funded Emergency Account

David had $40,000 in an HYSA. He stayed calm, upskilled in AI-integrated engineering, and secured a new role with a $20,000 raise. His investments remained untouched and continued compounding.

The emergency fund didn’t just cover expenses — it protected his long-term wealth.

7. Most Common Emergency Fund Mistakes in 2026

- “I’ll Save What’s Left” Mentality: You’ll never have leftovers. Pay yourself first.

- Failing to Refill: If you spend $2,000 on a dental emergency, your next financial goal is refilling that $2,000 — even before investing.

- Mixing Financial Goals: Never use your house down payment or vacation savings as your emergency fund. A car repair shouldn’t delay your dream home.

Final Thoughts: Emergency Funds Are Financial Insurance for Your Soul

An emergency fund is the only financial tool that delivers an immediate emotional return — lower stress, better sleep, and higher decision-making power.

In an era of AI disruption, global uncertainty, and rising living costs, the greatest asset you can own is Time.

An emergency fund isn’t about being rich — it’s about being uncancelable. It gives you the power to say no to toxic work environments, wait for the right opportunity, and face life’s worst moments with dignity instead of desperation.

This guide is a deep-dive exploration into the mechanics of liquidity, the psychology of safety, and the precise math required to protect your peace of mind in 2026.

Emergency Fund FAQs

How much emergency fund should I have in 2026?

Most financial experts recommend saving 3 to 6 months of essential living expenses. However, in 2026, professionals with unstable income or dependents should aim for 6 to 12 months.

Where should I keep my emergency fund?

The best place to store an emergency fund is a high-yield savings account or money market account that offers both liquidity and interest growth.

Is an emergency fund more important than investing?

Yes. An emergency fund should be built before aggressive investing, as it protects you from selling investments during market downturns.