📝 Introduction: Why Saving Money Matters More Than Ever

Learning how to save money in Tier 1 countries is no longer just a financial goal—it is a vital survival skill in 2025. In high-cost economies like the USA, UK, Canada, and Australia, rising rents and grocery prices can quickly deplete even a comfortable salary. This guide provides a proven framework to help you navigate these expensive markets, showing you exactly how to save money in Tier 1 countries without sacrificing your quality of life.

This comprehensive guide is designed to dismantle the myths surrounding personal finance and equip you with practical, realistic, and proven strategies to save money without compromising your quality of life. Whether you’re a salaried employee navigating corporate life, a freelancer building your empire, a student balancing books and budgets, or a business owner striving for financial stability, these strategies are universally applicable and have been successfully implemented by financially stable individuals across all save money in Tier-1 countries.

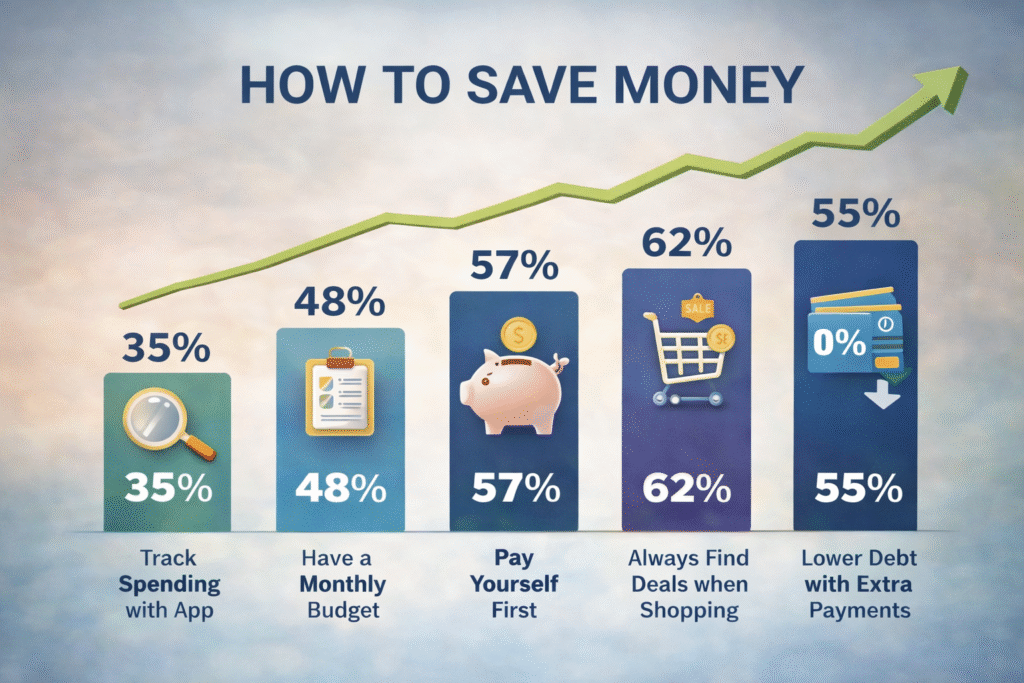

⭐ 1. Understand Where Your Money Is Going: The Foundation of Financial Control

Imagine trying to navigate a ship without a map. That’s precisely what most people do with their finances. Before you can effectively save money, you absolutely must understand the intricate flow of your income and expenses. This initial step is arguably the most crucial, as it uncovers the often-invisible spending habits that silently drain your bank account. Studies consistently show that individuals tend to underestimate their spending by a significant margin, often 20-30% or even more. This “financial blind spot” is the first hurdle we need to overcome.

What to Track: A Detailed Breakdown

To gain a crystal-clear picture of your financial landscape, you need to meticulously categorize and record every dollar, pound, or loonie that enters and leaves your possession. Here’s a detailed list of categories to focus on:

- Housing (Rent/Mortgage): This is often the largest single expense for most individuals in Tier-1 countries. Include property taxes, insurance, and HOA fees if applicable.

- Utilities: Electricity, gas, water, internet, and sometimes garbage collection. These are essential but often fluctuate.

- Food & Groceries: This category can be surprisingly high. Separate groceries (supermarket purchases) from dining out (restaurants, cafes, takeaways).

- Transportation: Fuel, public transport passes, car payments, insurance, maintenance, parking, and ride-sharing services.

- Subscriptions & Memberships: Streaming services (Netflix, Spotify, Disney+), gym memberships, software subscriptions, app subscriptions, online news, etc. These often accumulate unnoticed.

- Entertainment & Recreation: Movies, concerts, hobbies, social outings, sports events, vacations.

- Personal Care: Haircuts, toiletries, cosmetics, gym memberships (if not in subscriptions).

- Healthcare: Insurance premiums, co-pays, prescription medications, dental visits, eye care. Even with public healthcare systems, there can be significant out-of-pocket costs.

- Debt Payments: Credit card minimums, student loan payments, personal loan payments (excluding mortgage).

- Childcare/Education: Daycare, school fees, tutoring, extracurricular activities, college savings.

- Clothing: New apparel, shoes, accessories.

- Miscellaneous: Those small, infrequent purchases that don’t fit neatly elsewhere – gifts, charitable donations, home repairs, pet supplies.

Best Tools (Tier-1 Friendly) for Expense Tracking:

Gone are the days of manual ledger books (unless you prefer them!). Modern technology offers incredibly powerful and user-friendly tools to automate and simplify expense tracking:

- Mint (USA, Canada): A popular free budgeting app that connects to your bank accounts and credit cards, automatically categorizing transactions and providing a holistic view of your finances. It also offers bill tracking and credit score monitoring.

- YNAB (You Need A Budget) (Global, popular in Tier-1): A paid app (with a free trial) that uses the “zero-based budgeting” philosophy. You assign every dollar a job, ensuring no money is left unaccounted for. It requires more active engagement but offers profound insights and control.

- PocketGuard (USA, Canada): A user-friendly app that helps you visualize your “in my pocket” money after accounting for bills and savings goals. It helps prevent overspending by showing you what’s truly available.

- Bank Apps / Online Banking Platforms (Universal): Most major banks in Tier-1 countries offer robust online platforms and mobile apps that allow you to view transaction histories, categorize spending, and even set up alerts. While not as sophisticated as dedicated budgeting apps, they are a great starting point.

- Spreadsheets (Excel, Google Sheets): For those who prefer a more manual, customizable approach, a simple spreadsheet can be incredibly effective. You create categories, input transactions, and use formulas to calculate totals. Many free templates are available online.

Let’s take Sarah, a marketing professional in London, UK, earning £3,000 net per month. For years, she felt like her money just disappeared. She started tracking her expenses diligently for 30 days using her bank’s app and a simple Google Sheet.

- Month 1 Tracking Revelation:

- Rent: £1,200

- Utilities: £150

- Groceries: £300

- Eating Out/Takeaways: £450 (😱 Sarah’s biggest shock!)

- Commute (Tube Pass): £180

- Subscriptions (Netflix, Gym, Music): £60

- Shopping (Clothes, Impulse Buys): £280

- Socializing (Pubs, Events): £200

- Miscellaneous: £90

- Total Expenses: £2,910

Sarah realized she was spending nearly 15% of her income just on eating out – a habit she hadn’t even fully registered. Her impulse shopping was also much higher than she thought. This single month of tracking immediately saved her hundreds by simply making her aware of where her money was going. She decided to cut takeaways by half and allocate a strict budget for shopping.

⭐ 2. Create a Simple Monthly Budget (That Actually Works)

Once you know where your money is going, the next logical step is to tell it where to go. This is the essence of budgeting. Many people dread budgeting, equating it with restriction and financial straightjackets. However, a well-constructed budget doesn’t restrict your freedom; it creates it. It gives you permission to spend within your means, pursue your goals, and avoid the anxiety of living paycheck to paycheck.

A budget is simply a plan for your money. It allocates your income to different categories of spending, saving, and debt repayment. The key is to make it simple and sustainable, not overly complex or rigid, which often leads to abandonment.

The 50 / 30 / 20 Rule: A Practical Framework

One of the most popular and effective budgeting frameworks, particularly for those new to budgeting, is the 50/30/20 rule. It’s flexible, easy to understand, and widely applicable across different income levels in Tier-1 countries.

- 50% → Needs: These are the essential expenses required for survival and maintaining your job/lifestyle. Think of things you cannot realistically live without.

- Examples: Housing (rent/mortgage), utilities, essential groceries, minimum debt payments, transportation to work, basic healthcare, insurance.

- 30% → Wants: These are non-essential expenses that improve your quality of life but aren’t strictly necessary.

- Examples: Dining out, entertainment, subscriptions, hobbies, vacations, new clothes (beyond basic needs), designer coffee, gym memberships (if not essential for health).

- 20% → Savings & Investments: This portion is dedicated to building your financial future and security.

- Examples: Emergency fund contributions, retirement accounts (401k, IRA, Superannuation, Pension), down payments for a house, investment accounts, paying off high-interest debt above the minimum.

Example (USA): Applying the 50/30/20 Rule

Let’s consider Mark, a software developer in Austin, Texas, USA, with a net (after-tax) monthly income of $4,000.

- 50% Needs ($2,000):

- Rent: $1,200

- Utilities (electricity, internet, water): $200

- Groceries (essential): $300

- Car Payment/Insurance/Gas: $200

- Total Needs: $1,900 (well within the $2,000 budget)

- 30% Wants ($1,200):

- Dining Out/Takeaways: $300

- Entertainment (movies, concerts): $150

- Subscriptions (Netflix, Spotify): $50

- New Gadget/Clothing: $200

- Vacation Fund: $500

- Total Wants: $1,200 (perfectly aligned)

- 20% Savings & Investments ($800):

- Emergency Fund: $300

- 401k Contribution: $500

- Total Savings: $800 (meeting the target)

Mark can adjust these specific amounts within each category, but the overall percentages provide a clear guideline. If his rent was higher, he might need to cut back on his “wants” or find ways to increase his income to keep his budget balanced.

Adjust Based on Your City and Lifestyle:

It’s crucial to understand that the 50/30/20 rule is a guideline, not a rigid law.

- High-Cost-of-Living Cities: In places like New York City, Sydney, or Vancouver, your “needs” might consume more than 50% of your income, especially housing. In such cases, you might adjust to a 60/20/20 or even 70/15/15 split. The goal is to maximize savings where possible without sacrificing basic necessities.

- Lower Income: If your income is lower, you might find more goes to needs, and your “wants” and “savings” percentages are smaller. The principle remains: prioritize needs, then allocate to wants and savings intentionally.

- Debt Repayment: If you have significant high-interest debt (like credit card debt), you might temporarily reallocate some of your “wants” or “savings” percentage to aggressive debt repayment, as paying off high-interest debt is effectively a form of saving (it saves you interest payments).

Real-World Chart Example: Monthly Budget Breakdown for a Canadian Individual Imagine “Emily” in Toronto, Canada, with a net monthly income of CAD $3,500.

Key Takeaway: A budget isn’t about being perfect; it’s about being intentional. Start simple, track for 30 days to inform your categories, then create a budget that reflects your income and goals using the 50/30/20 rule as a guide. Review and adjust it monthly as your circumstances change.

⭐ 3. Pay Yourself First: The Most Powerful Habit for Wealth Accumulation

This concept is deceptively simple yet profoundly transformative. “Paying yourself first” means that before you pay any bills, before you go shopping, and before you allocate money to anything else, a portion of your income is automatically directed towards your savings and investments. It flips the traditional spending model on its head, ensuring your financial future is prioritized, not an afterthought.

Most people pay their bills, spend on wants, and then save whatever is left over – which, more often than not, is nothing. Paying yourself first guarantees that your savings goals are met consistently, regardless of daily spending decisions.

How to Implement “Pay Yourself First”: Automate, Automate, Automate!

The magic of this habit lies in its automation. By setting up automatic transfers, you remove the need for willpower and the temptation to spend.

- Emergency Fund: Set up an automatic weekly or bi-weekly transfer from your checking account to a separate high-yield savings account dedicated solely to your emergency fund. Even small, consistent transfers add up rapidly.

- General Savings Account: Whether it’s for a down payment, a large purchase, or a dream vacation, create a separate savings account and automate transfers. Label it clearly to keep you motivated.

- Retirement Contributions: This is perhaps the most critical area for automation.

- USA: Contribute automatically to your 401(k) (pre-tax, employer-sponsored) or Roth IRA (after-tax, individual). Many employers offer a matching contribution – always contribute at least enough to get the full match, as it’s free money (often a 100% return on investment!).

- UK: Contribute to your workplace pension scheme (often deducted directly from your salary) or a SIPP (Self-Invested Personal Pension).

- Canada: Automate contributions to your RRSP (Registered Retirement Savings Plan) or TFSA (Tax-Free Savings Account).

- Australia: Your employer contributes to your Superannuation. Consider making additional voluntary contributions if your budget allows.

The Power of Compounding: A Real-Life Illustration

Let’s look at the incredible impact of consistent, automated savings over time, thanks to the magic of compound interest.

Imagine David, a young professional in Sydney, Australia, who decides to pay himself first by automating just $200 per month into an investment account earning an average annual return of 8% (a reasonable historical average for a diversified investment portfolio).

- After 5 years: David has contributed $12,000, but his balance has grown to approximately $14,692.

- After 10 years: He has contributed $24,000, and his balance is around $36,839.

- After 20 years: He has contributed $48,000, but his balance has soared to approximately $110,034!

- After 30 years: He has contributed $72,000, and his balance has reached an astonishing $299,697!

That $200/month, initially seeming small, becomes nearly $300,000 in 30 years, with over $227,000 of that being pure investment growth (compound interest)!

Chart Example: The Growth of $200/Month Savings Over 30 Years (8% Annual Return)

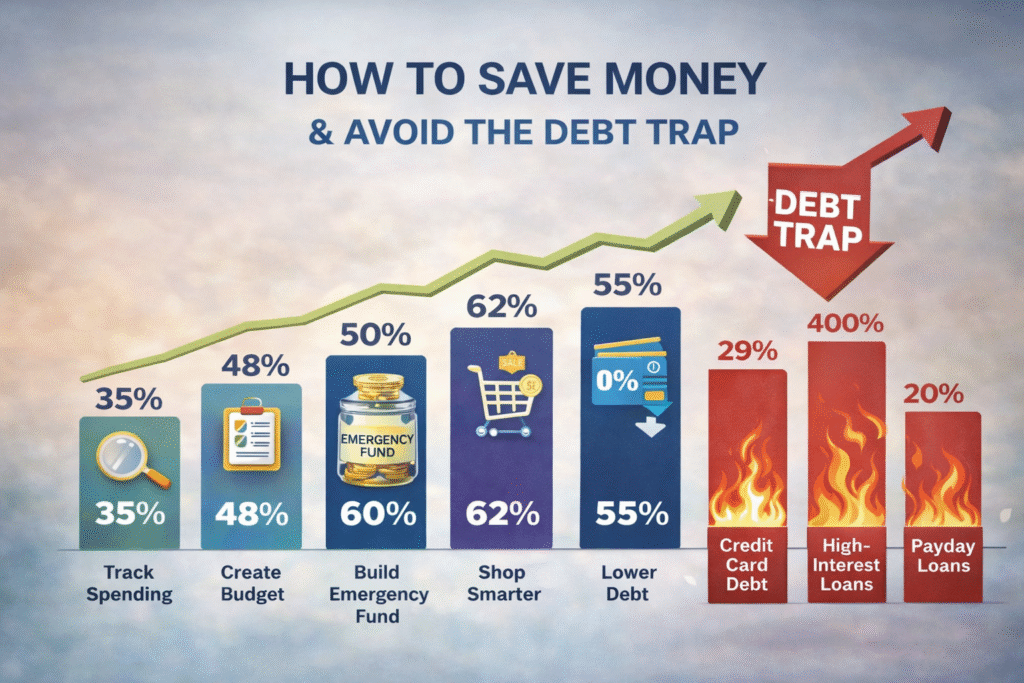

⭐ 4. Build an Emergency Fund: Your Financial Shield

In Tier-1 countries, a single unexpected event—a transmission failure in your car, a sudden plumbing leak, or a corporate “restructuring”—can cost thousands. Without a buffer, these events often land on high-interest credit cards, starting a debt spiral.

- The Target: Aim for 3–6 months of essential living expenses. If you are self-employed or in a volatile industry, aim for 9–12 months.

- Where to Store it: Use a High-Yield Savings Account (HYSA). In 2025, online banks like Peak Bank, Ally, or Marcus offer rates around 4.00% to 4.25% APY, far better than the 0.01% at traditional “Big Banks.”

- Real-World Example: If your “Needs” (Rent + Utilities + Food) cost $2,500/month, your starter goal is $7,500. Once you hit this, you are effectively “recession-proof.”

⭐ 5. Cut “Invisible” Money Leaks

Most financial “bleeding” happens in small, recurring amounts. In the UK and USA, the average person spends over $200/£150 per month on subscriptions they rarely use.

- Audit Subscriptions: Use apps like Rocket Money or Emma to find forgotten gym memberships or streaming trials.

- The “48-Hour Rule”: For non-essential online shopping, leave items in your cart for 48 hours. In 60% of cases, the impulse passes, and you’ll delete the item.

- Insurance Shopping: In Canada and Australia, loyalty to insurance companies rarely pays. Switching your car or home insurance every 12 months can save an average of $300–$500 annually.

⭐ 6. Shop Smart: The “Unit Price” Strategy

Prices in Tier-1 supermarkets are designed to be confusing. A large box of cereal might actually be more expensive per gram than two small ones.

- The Hack: Look at the Unit Price (the tiny text on the shelf label that says “price per 100g” or “price per oz”). In 2025, generic store brands (like Kirkland, Aldi, or Tesco Essentials) are often manufactured in the same facilities as name brands but cost 30% less.

- Cashback Stacking: Use apps like Rakuten (USA/Canada) or Cashrewards (Australia) paired with a rewards credit card. If you spend $1,000/month on essentials, a 2% cashback stack yields $240/year for doing nothing differently.

⭐ 7. Housing & Transport: The “Big Rocks”

You can’t “latte-factor” your way out of a housing crisis. These two categories typically consume 60% of a Tier-1 budget.

- Housing: If you’re a renter in a city like London or Sydney, consider “House Hacking”—renting out a spare room on Airbnb or taking a flatmate. Negotiating your lease at the end of the term by showing “market comparables” can often freeze a rent hike.

- Transport: The average car payment in the USA has hit $700/month. Switching to a reliable used car (3–5 years old) and paying cash can save money in Tier-1 countries you $8,000/year in interest and depreciation.

⭐ 8. Avoid the Debt Trap

Credit card interest in Tier-1 countries is currently hovering between 18% and 29%. Carrying a $5,000 balance at 25% interest means you are paying $1,250 a year just to exist in debt.

- The Strategy: Use the Debt Avalanche method. List all debts by interest rate and attack the highest rate first while paying minimums on others. This is mathematically the fastest way to save money.

⭐ 9. Increase Income to Accelerate Savings

In 2025, the gap between wages and inflation makes saving difficult on a single income.

- Skill Arbitrage: Use platforms like Upwork or Fiverr to sell high-value Tier-1 skills (Copywriting, Project Management, AI prompt engineering) to global clients.

- Passive Income: Consider Index Fund Investing (like the S&P 500 or Vanguard LifeStrategy). Over the last 30 years, these have averaged a 7–10% return, allowing your saved money to work harder than you do.

🏁 Conclusion: The Path to Freedom

Saving money in the USA, UK, Canada, or Australia isn’t about “getting lucky”; it’s about systems. By tracking your leaks, automating your “pay yourself first” habit, and attacking high-interest debt, you move from a state of survival to a state of wealth.

Final Note: Your greatest financial asset isn’t your salary—it’s time. Start today, even with $10.

1 thought on “How to save money in tier 1 countries”