📝 Introduction: The Invisible Architecture of Wealth

The psychology of money is the study of how people think, feel, and behave with money, showing why mindset matters more than income or intelligence in building wealth.In the high-octane economies of the United States, United Kingdom, Canada, and Australia, we are constantly bombarded with financial “math.” We track interest rates, inflation figures, stock market tickers, and salary increments. However, the most successful individuals understand a truth that the middle class often overlooks: Money is not a math problem; it is a behavior problem.

Imagine two neighbors in a suburb of Sydney or Toronto. Both earn $150,000 a year. One drives a leased luxury SUV, dines at five-star restaurants every weekend, and has a mounting credit card balance. The other drives a five-year-old sedan, invests 20% of their income into index funds, and has a net worth that grows silently every month. Twenty years later, one is a multi-millionaire with complete freedom, while the other is drowning in “lifestyle debt” and terrified of retirement.

The difference isn’t intelligence, access to information, or luck. It is The Psychology of Money. In Tier-1 countries, the cost of living is undeniably high, but the cost of status is even higher. To build wealth from scratch, you must transition from a “consumer mindset” to an “owner mindset.” This 3,000-word deep dive explores the psychological frameworks used by the wealthy to master their emotions, respect time, and build a fortress of financial independence.

⭐ 1. Behavior vs. Knowledge: The Great Divide

Financial literacy is often taught as a technical skill, much like engineering or medicine. We assume that if we learn the formulas for compound interest or the tax implications of a 401(k) or an ISA, we will naturally become wealthy. But being “smart” with money has little to do with your IQ and everything to do with your EQ (Emotional Quotient).

The “Genius” Who Went Broke

Consider the real-life story of Ronald Read, an American philanthropist, healthcare worker, and gas station attendant. Read lived a quiet life in Vermont. When he died in 2014 at the age of 92, he had $8 million in the bank. He didn’t win the lottery; he simply spent less than he made and invested in blue-chip stocks for decades, allowing time to do the heavy lifting.

Compare him to Richard Fuscone, a Harvard-educated Merrill Lynch executive with an MBA. Fuscone was the epitome of financial “knowledge.” Yet, driven by ego and a desire for status, he borrowed heavily to build a 20,000-square-foot mansion with 11 bedrooms and two swimming pools. When the 2008 crisis hit, his illiquid assets and massive debt led him to bankruptcy.

The Lesson: A janitor with no financial education but superior behavioral discipline can outperform a Harvard MBA with poor emotional control. In the world of money, how you behave is more important than what you know.

Controlling the “Gap”

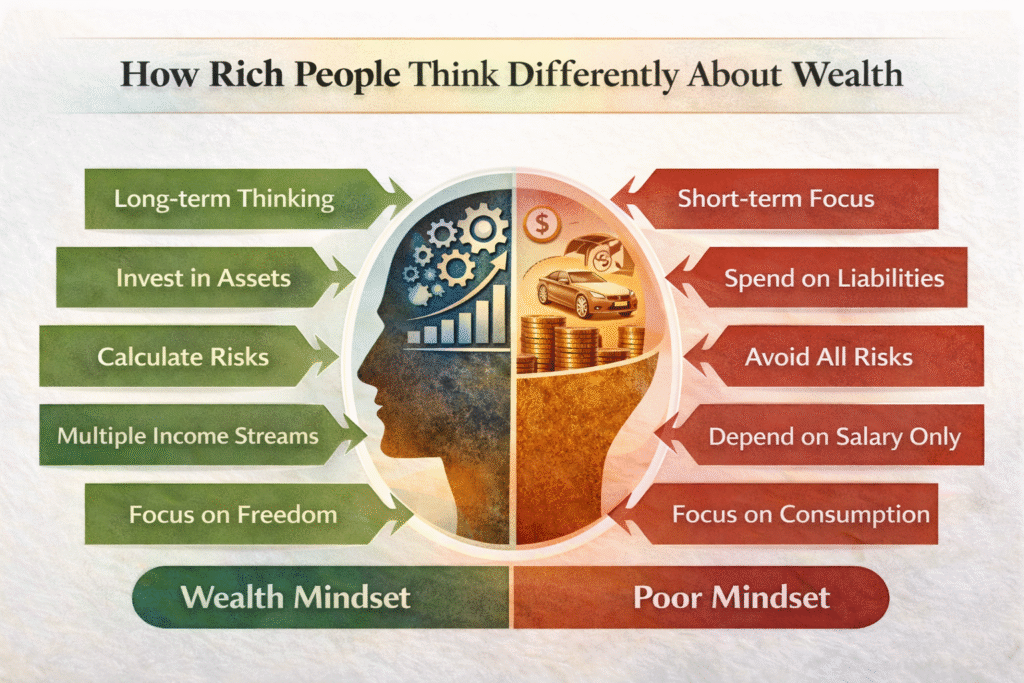

Wealthy people are obsessed with the Gap—the space between what they earn and what they spend.

- Middle-Class Thinking: “If I earn more, I can finally buy that better car/house/watch.”

- Wealthy Thinking: “If I earn more, I can widen the gap to buy more freedom.”

⭐ 2. The Long Game: Compounding Is a Test of Character

In the UK or Australia, the culture often leans toward “sensible saving,” while in the US, there is a push for “disruptive growth.” Regardless of the regional flavor, the engine of wealth remains compounding is powerful. Compounding is powerful when you start early. How to start investing early is one of the biggest advantages wealthy people use to turn time into money.

The “Boring” Path to Millions

Wealthy people are comfortable with boredom. They understand that $1,000 invested at age 20 is worth significantly more than $10,000 invested at age 40.

Real-World Example: If a 20-year-old in London invests £200 a month into a standard global index fund (averaging 7% annually), they will have approximately £525,000 by age 60.

However, if they wait until age 30 to start—even if they invest the same amount—they end up with roughly £240,000.

That ten-year delay costs them nearly £300,000 in “lost” growth.

The psychology here is difficult because humans are wired for “linear” thinking, but money grows “exponentially.” We expect to see big results in year one, but in a 40-year investment journey, 80% of the growth happens in the final 10 years.

The Psychology of Back-Loading

The rich have the psychological stamina to stay the course while others quit to chase “get-rich-quick” schemes or “meme stocks” that promise instant gratification. They treat their portfolio like a tree: they plant it, water it, and then leave it alone.

⭐ 3. Respecting Risk: Survival Over Returns

Most people think rich people are “high-stakes gamblers.” In reality, the truly wealthy are professional risk-managers. They are obsessed with one thing: Survival.

The “Margin of Safety”

Whether it is the housing market in Toronto or the FTSE 100 in London, volatility is a feature, not a bug. The rich build a “Margin of Safety” to ensure that a bad year doesn’t turn into a catastrophic decade.

- Liquidity: In 2023, when tech layoffs hit the USA and Australia, those with 6–12 months of cash in High-Yield Savings Accounts (HYSAs) didn’t panic. They didn’t have to sell their stocks at a 20% loss just to pay their mortgage.

- The “Un-killable” Mindset: The goal is not to have the highest returns in the neighborhood this year; it is to be the one who never gets “wiped out.” If you can survive the bear markets without selling, the bull markets will eventually make you rich.

⭐ 4. Ego Is the Enemy of Wealth

In Tier-1 countries, lifestyle inflation is the primary reason high earners stay poor. We are socially conditioned to signal our success through consumption.

Wealth is Invisible

True wealth is the cars not purchased, the first-class tickets not booked, and the designer clothes left on the rack.

Real Example: In wealthy enclaves like Sydney’s North Shore or the “Millionaire Next Door” suburbs in America, you will find that the person with a $5 million net worth is often driving a five-year-old Toyota. Meanwhile, the person in the “middle-class trap” is driving a leased BMW with a $1,200 monthly payment just to maintain a social image.

- Status vs. Wealth: “Rich” is a current income (visible). “Wealth” is a net worth (invisible).

- The Rich Mindset: They find success in the option to do whatever they want with their time, rather than the temporary dopamine hit of a neighbor’s approval.

⭐ 5. Financial Independence vs. Luxury

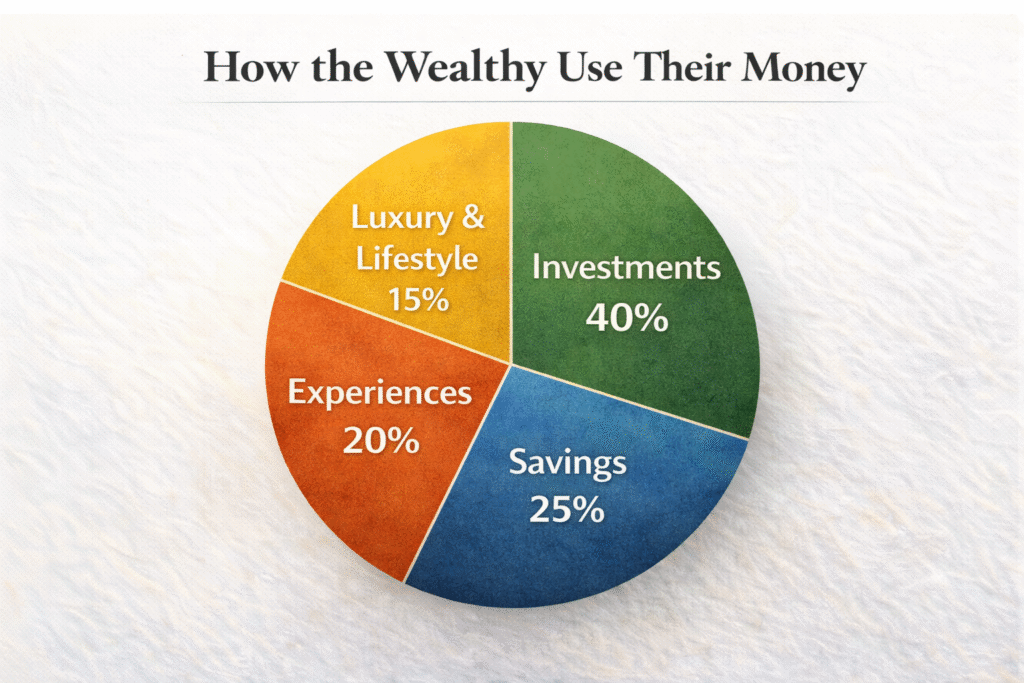

For the wealthy, money is a Time Machine. It is the only asset that can buy back your hours.

The Utility of Money

Once you reach a certain level of income—roughly $75,000 to $100,000 in most Tier-1 cities—the marginal utility of an extra dollar for “stuff” diminishes rapidly. However, the utility of an extra dollar for “freedom” is infinite.

Tier-1 Reality: In expensive cities like Vancouver or NYC, people often sacrifice their health, sleep, and family time to pay for a “luxury” lifestyle they are too busy to enjoy. The wealthy prioritize time-wealth.

- The Trade-off: They would rather have a $1.5M net worth and total control over their Tuesday morning (free to hike, read, or grab coffee) than a $5M net worth and a 100-hour-a-week corporate job that causes chronic hair loss and stress.

⭐ 6. Luck, Risk, and Humility

The psychology of money requires an admission that the world is too complex for 100% of your actions to dictate 100% of your outcomes.

The Role of “Tail Events”

Wealthy people acknowledge that “Tail Events”—unpredictable outliers—drive most of the world’s wealth.

- If you bought a house in London in 1990, you aren’t necessarily a real estate genius; you were a beneficiary of a massive tail event in urban migration.

- If you invested in Amazon in 2002, you weren’t just “right”; you survived a period where 99% of other dot-coms went to zero.

The Action: The rich stay humble during wins. They know that a lucky break in the market doesn’t mean they are invincible. This humility prevents the “arrogance trap”—taking on massive debt (leverage) at the top of a cycle because you think you can’t lose.

⭐ 7. The Power of “Enough”

The hardest financial skill is getting the goalpost to stop moving. In a capitalistic society, the pressure to “more” is relentless.

Avoiding the Never-Ending Chase

If you always want more, you will eventually take risks that you shouldn’t. You will risk what you have and need for what you don’t have and don’t need.

Real Example: Many successful entrepreneurs in the USA sell their businesses for $10 million, only to feel “poor” because they moved to a neighborhood in the Hamptons where everyone has $100 million. They end up back on the treadmill, risking their family’s security to chase a status they don’t even enjoy.

The “psychological rich” are those who recognize when they have reached their target and pivot from “wealth accumulation” to “wealth preservation and life enjoyment.”

⭐ 8. Ownership: The Tier-1 Advantage

In the USA, UK, Canada, and Australia, the tax systems and legal structures are fundamentally designed to favor owners over laborers.

Asset Allocation over Salary

Rich people don’t just work for a paycheck; they work for Equity. * Real Estate: Owning property in high-demand markets like Melbourne, Auckland, or Austin.

- Equities: Owning pieces of the world’s most profitable companies via Index Funds (Vanguard, Blackrock, State Street).

- The Mindset: “I want to own the machine, not just be a gear in the machine.” While the laborer pays the highest tax rates (Income Tax), the owner pays lower rates (Capital Gains Tax or Dividend Tax). They understand that you cannot save your way to true wealth through a salary alone; you must own assets that grow while you sleep.

⭐ 9. Money as a Utility, Not a Scorecard

When you view money as a scorecard, you are never satisfied because there is always someone with a higher score. When you view it as a utility, you become its master.

Reducing Friction and Stress

The rich use money to solve “low-level” problems so they can focus on “high-level” joys.

Real Example: Hiring a cleaner or using a grocery delivery service in Toronto isn’t about “being lazy.” It’s about buying back 4 hours of your weekend to invest in your health (the gym) or a side business. They understand that the highest dividend money pays is Peace of Mind. If money can’t buy you out of a stressful situation, you haven’t really “won.”

⭐ 10. Consistency Over Brilliance

You don’t need to be a genius to be wealthy in a Tier-1 country. You just need to be unusually consistent.

Systems Over Goals

The rich don’t just have a vague goal to “be a millionaire.” They build a system that makes failure impossible.

- The Automation Hack: “Many wealthy people succeed by automating investments so money grows without effort.”the day the paycheck hits—before they ever see it.

- The Psychology: They remove the decision-making process. By automating, they avoid “decision fatigue” and the emotional temptation to spend that “extra” cash on a flash sale or a new gadget. They make saving the default and spending the effort.

⭐ 11. The Psychology of “Mental Accounting”

Most people treat money differently depending on where it came from. This is a psychological trap called “Mental Accounting.”

- If you get a tax refund of $2,000, you might treat it like “play money” and blow it on a vacation.

- If you worked 100 hours of overtime for that same $2,000, you would likely be much more careful with it.

The Rich Mindset: They understand that $1 is $1. Whether it came from a dividend, a salary, or a gift, it has the same power to compound. They don’t treat “found money” differently than “earned money.”

⭐ 12. Avoiding the “Lottery” Mindset

In the UK and Australia, sports betting and lotteries are massive industries. In the USA, “get-rich-quick” crypto schemes dominate social media. These are taxes on people who don’t understand the psychology of money.

The rich know that wealth is a marathon, not a sprint. They avoid “asymmetric downside”—scenarios where you can lose everything for a small chance of winning big. Instead, they look for “asymmetric upside”—investing in their skills and the broad market where the downside is limited (you can only lose what you put in) but the upside is potentially infinite over 30 years.

🏁 Conclusion: Your Mindset Is Your Greatest Asset

The psychology of money proves that financial success is 80% behavior and 20% knowledge. In the USA, UK, Canada, and Australia, the path to prosperity is open to anyone willing to master their ego and respect the power of time.

Wealth is not built in the bank; it is built between your ears. “By shifting your focus toward financial independence, you unlock the true potential of your finances.”, You stop being a slave to the “status treadmill” and start being the architect of your own time.

⭐ Final Checklist for a Wealthy Mindset:

- Track Behavior: Audit your bank statements for the last 90 days. Are you spending on your values or your neighbors’ opinions?

- Automate Everything: Set up your “Wealth System” so that investments happen without you needing to think about it.

- Think in Decades: The stock market is a rollercoaster; don’t get off in the middle of the ride just because it’s scary.

- Define “Enough”: Set a target for your freedom, reach it, and then stop risking your happiness for more “points” on the scorecard.

- Buy Freedom: Every $100 you save today is a small piece of your future independence. Treat it with the respect it deserves.